The Pros and Cons of Offshore Investment for Long-Term Financial Safety

The Pros and Cons of Offshore Investment for Long-Term Financial Safety

Blog Article

The Necessary Guide to Offshore Investment: Types and Their Benefits

Offshore financial investment offers an engaging variety of alternatives, each customized to satisfy certain financial purposes and run the risk of cravings. From the privacy paid for by overseas savings account to the stability of property holdings, the landscape is rich with chances for both property security and growth. Additionally, cars such as offshore trust funds and shared funds provide paths to diversification and strategic estate preparation. As the global economic situation remains to evolve, recognizing the nuances of these financial investment kinds ends up being increasingly essential for browsing potential benefits and challenges. What might be one of the most suitable option for your economic technique?

Offshore Bank Accounts

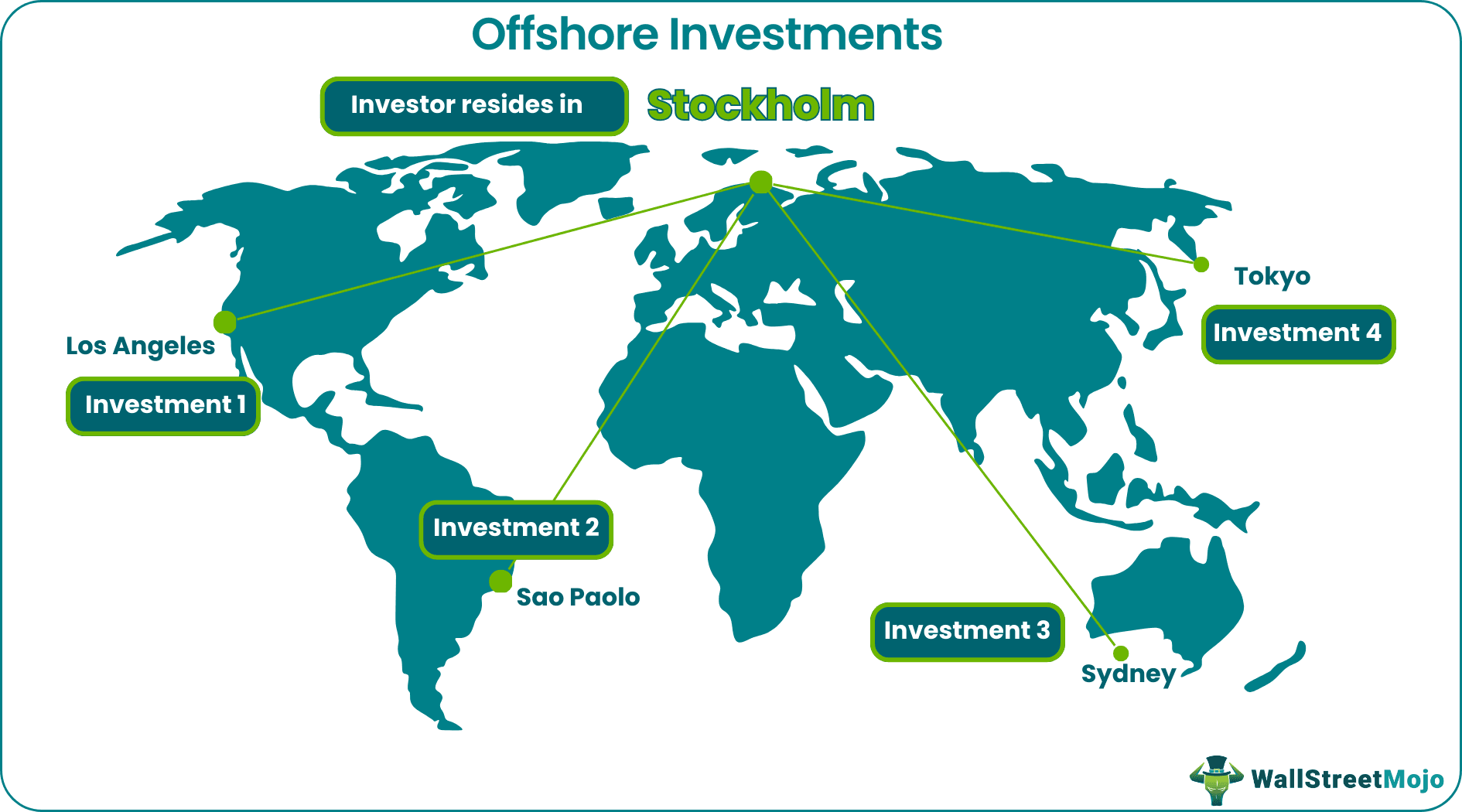

Offshore checking account have actually become progressively preferred among financiers looking for to diversify their financial portfolios and secure their properties. These accounts are normally developed in territories outside the investor's home country, providing different benefits that can enhance monetary security and privacy.

One primary benefit of overseas checking account is asset security. By positioning funds in an international institution, capitalists can shield their possessions from possible political or economic instability in their home country. Furthermore, overseas financial typically gives better confidentiality, enabling people to handle their riches without drawing in undesirable attention.

Moreover, overseas bank accounts may supply desirable tax obligation benefits, depending on the territory. While it is vital to abide by tax laws in one's home nation, certain overseas places provide tax obligation rewards to international financiers, which can cause enhanced returns on investments.

In addition, these accounts usually supply access to global monetary markets, enabling financiers to check out diverse financial investment possibilities that might not be available domestically. Generally, offshore checking account function as a tactical device for asset security, personal privacy, and monetary development in an increasingly globalized economic situation.

Realty Investments

The attraction of realty financial investments continues to grow amongst individuals seeking to diversify their portfolios and protected long-lasting economic gains. Offshore realty supplies distinct benefits, such as favorable tax regimens, asset security, and the possibility for capital admiration. Investors can take advantage of buildings in emerging markets or steady economies, enabling accessibility to a wider series of financial investment possibilities.

One key benefit of offshore realty is the capacity to safeguard assets from domestic economic changes or political instability. Residential or commercial property possession in an international territory can supply a layer of security and privacy, often attracting high-net-worth individuals. Investing in rental properties can produce constant revenue streams, improving overall economic stability.

Mutual Funds and ETFs

Buying exchange-traded funds and mutual funds (ETFs) provides an available method for individuals looking to expand their financial investment portfolios while decreasing dangers related to straight stock acquisitions. Both investment automobiles allow financiers to merge their resources, enabling them to spend in a broader variety of assets than they may take care of individually.

Shared funds are generally handled by specialist fund managers who proactively pick safety and securities based upon the fund's financial investment goal. Offshore Investment. This management can boost the potential for returns, though it commonly includes greater fees. In contrast, ETFs are generally passively handled and track a details index, giving lower expense ratios and higher openness. They can be traded throughout the day on stock market, adding versatility for financiers.

Both shared funds and ETFs use tax obligation benefits in an offshore context. Returns and funding gains might be tired favorably, depending upon the jurisdiction, making them attractive alternatives for global capitalists. In addition, their integral diversity can alleviate dangers connected with market volatility. Common funds and ETFs serve as efficient devices for developing wealth while browsing the intricacies of offshore investment chances.

Offshore Trust Funds

For investors looking for to further enhance their possession security and estate planning approaches, offshore trusts present a compelling option. These lawful entities enable individuals to move properties to a rely on a territory outside their home country, offering a variety of benefits that can guard riches and help with about his smooth sequence preparation.

One of the key advantages of overseas trust funds is the level of confidentiality they supply. By putting possessions in an offshore count on, capitalists can shield their wealth from public analysis, thereby shielding their personal privacy. Furthermore, offshore depends on can provide durable security versus lawful cases and possible financial institutions, properly insulating assets from threats associated with lawsuits or insolvency.

Offshore depends on also make it possible for flexible estate planning options. Investors can mark details beneficiaries and lay out the terms of possession circulation, making certain that their wishes are recognized after their passing away. This can be particularly valuable for people with complicated family characteristics or those wishing to offer for future generations.

Moreover, numerous overseas jurisdictions have established positive lawful structures created to support the facility and monitoring of trust funds, making them an eye-catching choice for discerning investors. In general, offshore trusts function as a tactical device for those wanting to enhance their economic heritage while mitigating possible threats.

Tax Obligation Benefits and Factors To Consider

While many financiers are attracted to overseas trust funds largely for possession security official website and estate preparation, considerable tax obligation advantages and considerations additionally merit attention. Offshore investment lorries can use favorable tax routines, which might cause lower tax obligations contrasted to onshore alternatives. Lots of territories give tax rewards such as tax deferments, lower funding gains rates, or perhaps total tax obligation exemptions on specific types of revenue.

However, it is crucial to navigate the complex landscape of global tax regulations. The Foreign Account Tax Conformity Act (FATCA) and various other policies need U.S (Offshore Investment). people and homeowners to report foreign properties, potentially bring about fines for non-compliance. In addition, the Irs (INTERNAL REVENUE SERVICE) may enforce taxes on offshore earnings, negating some benefits otherwise appropriately managed

Final Thought

To conclude, offshore investment choices present diverse possibilities for property defense, diversification, and estate planning. Offshore savings account improve personal privacy, while real estate financial investments give security against residential uncertainties. Mutual funds and ETFs assist in professional administration and threat reduction, and offshore trust funds use confidentiality in estate preparation. Comprehending the special benefits of each option is important for maximizing financial growth and properly taking care of tax obligation responsibilities in a significantly interconnected international economy.

Offshore real estate offers special benefits, such as favorable tax obligation programs, asset defense, and the possibility for capital recognition.While many investors are attracted to offshore counts on primarily for asset protection and estate planning, significant tax advantages and factors to consider also merit interest. Offshore financial investment cars can offer desirable tax obligation regimens, which might result in lower tax obligation liabilities compared to onshore choices.Financiers need to likewise think about the effect of regional tax laws in the offshore territory, as these can differ significantly. Eventually, while overseas investments can yield substantial tax obligation advantages, comprehensive due diligence and strategic preparation are extremely important to optimize their potential.

Report this page